welcome to

lighthouse finance

An international firm focussed on providing a full suite of accounting, tax, payroll, advisory and complementary services to internationally growing and scaling SMEs in the Netherlands, South Africa and the United Kingdom.

01

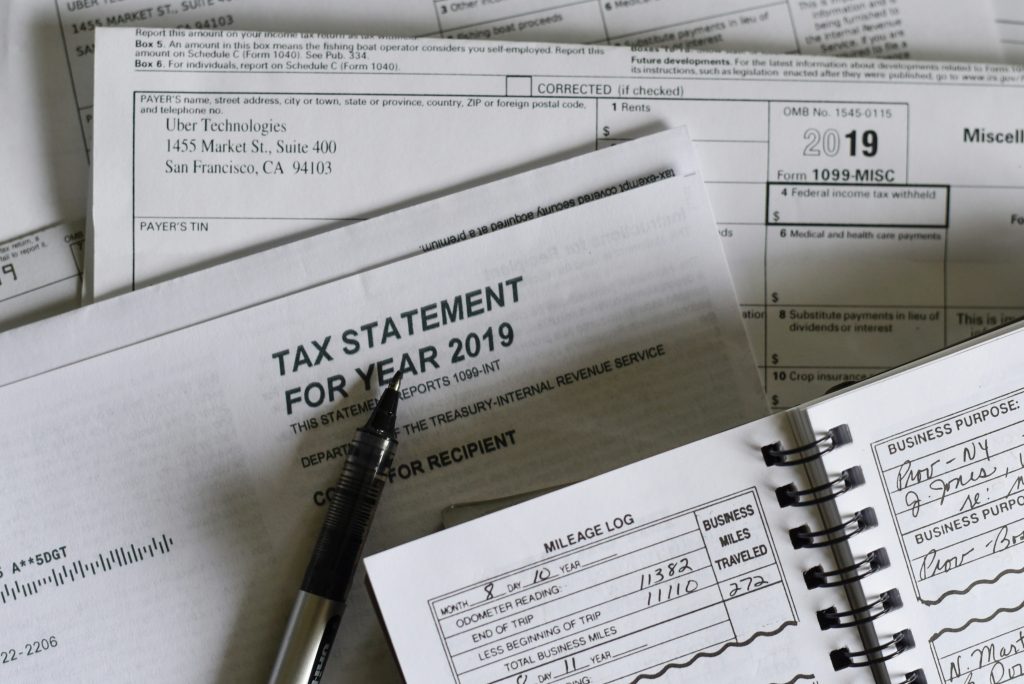

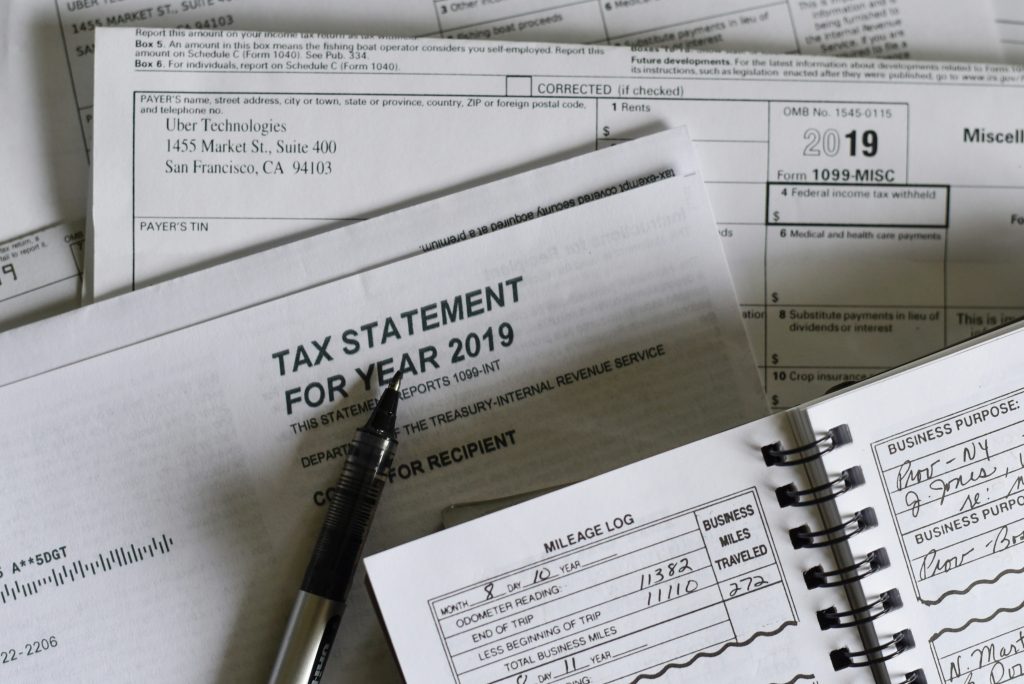

accounting & compliance

02

market entry &

exit

Setting up shop in a new country can be daunting. From choosing the right entity structure to incorporating to ensuring you’re properly registered with the local authorities, let us be your trusted partner and guide. And when its time to leave, we’re here as well to support you with liquidating your entity and financially emigrating.

03

employment & mobility solutions

Payroll law is complex and the impact of non-compliance can be severe. We’re here to ensure you mitigate that risk, from setting up and administering a payroll to immigration services like residence applications and 30% ruling applications and further, to bespoke advice and (offshore) employer-of-record solutions.

04

cfo &

strategy

Need a strategic sparring partner or a CFO but don’t have the budget for a full time hire? Speak to us about our fractional ‘Finance As A Service’ strategy & CFO offering.

05

advisory & consultancy

Our highly qualified and experienced senior staff are available for project-based advisory and consultancy work. Whether its a VAT or accounting manual, a process review or an international structuring project, we’re here to help.

trusted by our clients

our latest insights

Immigration to the Netherlands

International tax

30% ruling – The Netherlands

Personal tax Netherlands

Personal tax South Africa

Personal income tax United Kingdom

Corporate taxes United Kingdom

Corporate taxes South Africa

Corporate taxes Netherlands

Value added tax (VAT) in The Netherlands

we are proud to be registered as members of the following professional regulatory bodies

NIRPA

Lighthouse Finance was founded in 2016 by Simon Van Wyk, a Chartered Accountant with global experience working in mid-tier and Big 4 accounting firms, as well as corporate roles. With a vision to producing world-class quality at an affordable price for the international growing and scaling SME sector in the Netherlands and South Africa, Simon continues to lead what is now a highly skilled team of fifteen employees based in the Netherlands and South Africa, servicing clients in both countries as well as the UK.

From our early days offering basic bookkeeping, accounting and tax compliance to today, offering a full suite of services across a broad range of finance disciplines with accounting, tax and payroll services still at the heart of what we do, our core values of integrity, flexibility and transparency remain our guiding force and the client experience central to our identity as a firm.

Simon often refers to Lighthouse Finance (only half-jokingly) as the ‘smallest international accounting firm you’ve never heard of’. As we continue to grow year on year, that may not be true for much longer. If you’d like to join your journey as an entrepreneur with ours, reach out to us today!

meet the team

general faqs

We invest significant time and resources in training our team, from internal refresher sessions to external workshops and seminars hosted by our professional regulators and industry experts. In addition, we are regulated by various professional bodies in the Netherlands, such as NOAB, the RB and the NIRPA.

Whilst our back office accounting team is based in South Africa, our leadership is based in the Netherlands and speaks Dutch. We also have Dutch administration staff in the Netherlands as well.

Yes! At the Firm level we are regulated by the Institute of Chartered Accountants in England & Wales in the UK and the Dutch Order of Administration & Tax Experts (NOAB) in the Netherlands. Our leadership is also regulated at the individual level by the South African Institute of Chartered Accountants, the South African Institute of Taxation, the Dutch Registered Tax Advisors body, the Dutch Institute for Payroll Professionals and the Chartered Institute of Payroll Professionals in the UK.

As far as possible we work on a fixed fee basis. This is based on a scope of work that we define in conjunction with you at the commencement of an engagement. For ad-hoc work performed outside of that scope we will charge an additional fee, either fixed on a project basis or on an hourly basis, agreed upfront with you.

Unfortunately the fixed fee is not fixed forever. There are three situations that could result in a fee change:

- The actual time spent on the scope of work is significantly different from the expected time spend at commencement of the engagement, for example due to your business growth;

- The scope of work is changed; or

- There are increases in underlying costs, such as software subscriptions which we pay on your behalf or fixed fee deliverables such as tax returns.

Unlike many firms we do not apply a general annual inflationary increase each year! All fee increases are communicated in advance.:

We don’t have a specific rebate or discount scheme for new clients, as each fee is based on a bespoke scope developed for a specific client.

However, we do offer a rebate for clients who choose to pay our invoices using GoCardless, our direct debit order payment option. For these clients, we rebate 1.5% of their GoCardless payments for the previous year in January.

No, we do not work with contracts that require you to commit to a certain period of time. We understand that flexibility is critical for our clients, and if you find yourself in a situation where you wish to change supplier you are free to do so. We simply ask that you provide sufficient notice to us of your intentions in order to allow us to plan as well.

We offer the full range of bookkeeping, accounting, tax and payrolling services, from daily processing up to month, quarter and year-end close. In fact, the only service we don’t offer is auditing!

In addition to the ‘standard’ suite of services you’d expect from an accounting & tax firm, we offer other services as well, such as immigration work, employer of record solutions, accounting & tax manuals, international tax advice and market entry/exit (including financial immigration and emigration).

Have a look at our services page for more information!

Even if you can’t find what you’re looking for specifically, please get in contact with us anyway! If we can’t help you, chances are we know somebody who can and can refer you to them.

Our leadership is based in the Netherlands, along with our Dutch payroll and office management staff. Our Dutch based employees are largely Dutch citizens who speak the language and understand the culture, ensuring that we can advocate appropriately for our clients with relevant authorities and other parties.

Our accounting team is based in South Africa. We have an office in Cape Town, with other staff working remotely from Pretoria, Johannesburg, Durban and more! The accounting team are South African citizens and do not deal with Dutch authorities directly.

As a smaller firm we are able to offer our clients a true ‘single team’ solution. You will be assigned a relationship manager as your main point of contact, along with an accountant who will look after you and your group in its entirety. For Dutch clients, an additional team member in the form of our Dutch payroll team will also be part of your monthly process; again, for all entities covered under your engagement.

We’re Dutch, but not that Dutch! With a team of over 15 employees able to work from anywhere in the world with an internet connection you will always have coverage whatever your needs and whenever they arise – even during the (in)famous Dutch summer exodus to France!

The journey to becoming a client starts with an initial conversation to discuss your needs and current situation. Out of this we develop a scope of work together, following which we will send you a fee quote. Once you accept the quote our onboarding process kicks into gear and we will commence with our standard Know Your Client (KYC) checks, as well as request you to sign an engagement letter and agree to our terms and conditions. You will also be assigned a relationship manager to manage the commencement of the work itself.

To kick this process off contact us now!

We use software called SmartSearch to perform continuous real-time checks on our clients and their directors and Ultimate Beneficial Owners (UBOs). To do this we require you to identify all directors and UBOs and provide us with copies of their passports to retain on file. We will also potentially ask questions to enable us to understand your business and assess whether or not we are able to accept you as a client in terms of our professional regulations. Finally, we ask you to perform a Politically Exposed Person (PEP) self-declaration. However, most of the KYC work happens quietly in the background.